- The EU Taxonomy for sustainable activities is a new uniform language that helps to distinguish which investments contribute to the European environmental objectives

- Large public-interest companies with over 500 employees are required to report which part of their turnover and expenditure is in line with the Taxonomy

- The Taxonomy is a tool to help current business activities get in line with the transition to a sustainable economy.

- Large public-interest companies with over 500 employees need to align key performance indicators (KPI’s) to make it possible to report about the Taxonomy in the future

- To give insight in the EU Taxonomy, we explain the classification system and application. We share the first findings and recommendations from tests with the Taxonomy to help companies with the first steps.

Introduction

The EU Taxonomy for sustainable activities is a tool to help stimulate investment in sustainable economic activities. It is a new green language that companies need to learn in the coming years.

In the first ‘State of the Union’, President Ursula von der Leyen announced that the emission reduction target will be tightened: from the previous ambition of a 40 percent reduction to at least 55 percent less greenhouse gases in 2030 compared to 1990 (EC, 2020). The EU has a major task ahead of it, especially in the knowledge that by 2018 it had only managed to reduce 25.2 percent of greenhouse gases (EC-DGCA, 2020).

This requires an unprecedented transition in the economy. Companies need to transform their economic activities so that they fit into that low carbon economy. The Taxonomy helps with this by naming green activities.

To give insight in the Taxonomy, we explain the classification system and application in this report. Finally, we share the first findings and recommendations from tests with the Taxonomy to help companies with the first steps.

The EU Taxonomy

The Taxonomy is a list of economic activities within different sectors with technical screening criteria to substantially contribute and not to significantly harm environmental objectives. This tool is essential for the implementation of the EU Green Deal (TEG,2020).

Note that the Taxonomy is not a hallmark or eco-label, nor does it say anything about a company’s risk profile. An investment in an activity that is in line with the Taxonomy can be a financial risk.

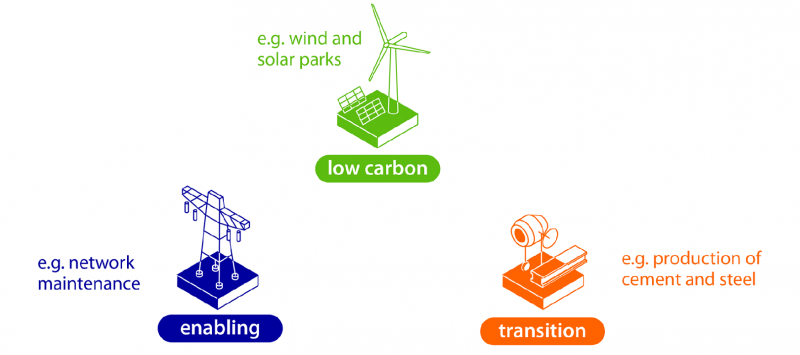

Three type of economic activities

When a company offers goods or services, it is performing an economic activity. The Technical Expert Group for Sustainable Finance (TEG, which developed the screening criteria for the Taxonomy) distinguishes in its advice between economic activities. It does this by indicating whether they contribute to the achievement of an environmental objective. The Taxonomy assigns the activities that contribute into three categories: low carbon, transition and enabling.

The low-carbon activities are sustainable in themselves, for example the production of solar or wind energy or the installation of a heat pump in the home. They make a direct contribution to the European emission reduction targets.

Transition activities help products and services with high CO2 emissions to low carbon ones. The production of plastic, steel, cement and aluminium are examples of activities with high CO2 emissions. Through a strict transition path, emissions are reduced. This is where the largest contribution to the climate objectives is expected. Enabling activities support the transition to low carbon activities. Examples are the construction of an electricity network or energy storage.

Sectors

Not every sector can contribute to an environmental objective. At this stage of the Taxonomy’s development, the TEG has focussed on reviewing the sectors that contribute to climate mitigation (i.e. reducing greenhouse gas emissions). The TEG has selected activities within sectors based on greenhouse gas emissions and opportunities to enable activities for the transformation from high to low emissions. Table 1 shows all sectors, ranked by emissions within the EU.

The TEG has identified specific sub-sectors within the main sectors that can contribute. It has also selected and listed 70 climate mitigation and 68 climate adaptation activities. The exact list of activities can be found in the TEG advisory report (TEG, 2020).

Not all sectors have been fully reviewed and even within fully considered sectors there are doubts about activities. The advice which activities should be included under the Taxonomy is not yet complete and will be further developed by the PSF. Box 1 shows more information on the economic activities that are not yet reviewed in the Taxonomy.

Box 1: Controversial, new or invisible sectors

Nuclear energy is not fully reviewed by the TEG. Although nuclear energy contributes to emission reduction targets, the TEG has not been able to conclude based on the scientific studies provided that it does not cause significant harm to other environmental objectives (read Technical Screening Criteria for further explanation). This is a condition for being part of the Taxonomy. To fully review nuclear energy and decide whether it can do significant harm or not, the European Joint Research Centre has been asked to start a study on 6th of July to determine whether nuclear energy should be included in the Taxonomy.

New technologies, such as nuclear fusion or the production of meat substitutes, are not yet part of the Taxonomy. The expectation is that there will be more new technologies that are not yet classifiable in a sector. The Platform for Sustainable Finance offers the opportunity to prove the sustainable value of the new technologies and to add them in a periodic review round to the Taxonomy.

Buildings are ‘invisible’ when it comes to sectors. Buildings contribute for 36 percent to CO2 emissions in Europe, but are spread over different sectors. For the time being, the TEG has included technical criteria for buildings in the construction, rental and trade of real estate. In this way, there is still an opportunity to make sustainable investments in buildings. Buildings that serve as fossil fuel storage are explicitly excluded.

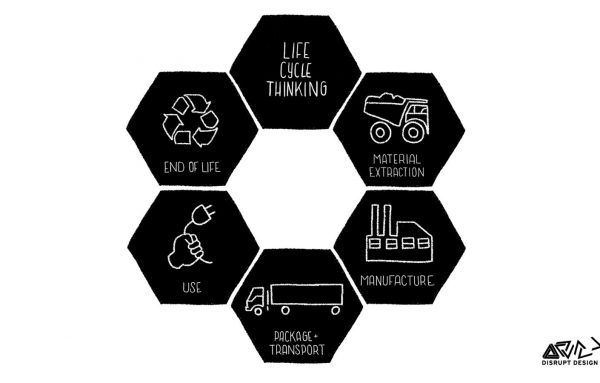

Climate is more than CO2

Achieving the European climate objectives is not only about reducing CO2 emissions. Recycling of plastic, conservation of specific animal species and prevention of discharge of toxic substances into the environment also play a role in the EU Green Deal. The Taxonomy therefore takes a broader view of the environment and assesses economic activities based on six environmental objectives, as shown in Figure 2.

In the current version of Taxonomy, only screening criteria for climate mitigation and adaptation have been reviewed. In studies applying the Taxonomy, only mitigation criteria are used instead of adaptation criteria. For more information, see box 2.

Box 2: Mitigation, but no adaptation (yet)

The UN-supported Principles for Responsible Investment (PRI) has implemented the draft version of the Taxonomy in a test group with more than forty investors. The group testing the Taxonomy focused on climate mitigation (PRI, 2020). The TEG has drawn up specific technical screening criteria for this purpose. These limits ultimately lead to (almost) no greenhouse gas emissions per unit of product. This is different for climate adaptation, because there is no final goal. A company, regardless of its economic activities, must always remain adaptive. That is why the TEG has drawn up adaptation criteria that apply to all economic activities and that are location- and context-dependent. In addition, there is a lack of (access to) data for all physical climate risks among the test group.

Technical Screening criteria

For each economic activity an upper and a lower limit has been set for each environmental objective.

The description of these limits varies from a specific emission per unit of product to management practices. Iron casting has a specific limit of 0.325 tCO2eqv/tonnes of product (TEG, 2020). The growing of (non-)perennial crops focussing on avoidance or reduction of greenhouse gasses ‘through the application of appropriate management practices‘(TEG, 2020). An economic activity must make a substantial contribution to one or more environmental objectives. A contribution is considered substantial to one of the six environmental objectives if a company reaches or even performs better than the upper limit set for its activity. In addition, the economic activity must not cause significant damage to the remaining environmental objectives, the lower limits. The current lower limits, or DNSH (Do No Significant Harm) criteria, are often based on EU regulations and contain additional technical criteria for the lower limit where necessary.

Finally, companies must demonstrate that they meet minimum social safeguards. The standards for this are taken from the OECD Guidelines on Multinational Enterprises (MNEs), the UN Guiding Principles on Business and Human Rights and the ILO Core Labour Conventions.

The upper and lower limits for environmental objectives will be periodically amended on the advice of the Platform for Sustainable Finance. The aim is to base the limits on the most current scientific insights and to tighten them in such a way that the goal of a climate-neutral economy is achieved.

The ‘thermometer’ above shows the upper and lower limits for the environmental objectives. The three types of economic activities fit into the thermometer as follows: Low-carbon activities make a substantial contribution in their own right and are located in the green zone. Transition activities go from orange, significant damage, to green. Enabling activities support both activities.

The current Taxonomy only tells us which activities contribute to the environmental objectives. There is no Taxonomy for economic activities that harm environmental objectives. The TEG does recognize that there are such activities. Drilling, transporting or storing fossil fuels for instance are considered not green but ‘brown’ economic activities (TEG, 2020). To make a proper distinction between what does and does not contribute to our sustainable future, TEG recommends research into a brown Taxonomy (TEG, 2020).

The Taxonomy in practice

European legislation obliges large public-interest companies with more than 500 employees to provide information on their non-financial performance, including their handling of the environment. From 2022, this also applies to Taxonomy. This means companies are obliged to report under the categorizations and objectives of the Taxonomy. Companies covered by the Non-Financial Reporting Directive (NFRD) are expected to declare which part of the turnover and expenditure is in line with the Taxonomy. This can be in an appendix to the annual financial report or in a separate annual sustainability report. Within Europe, some 6,000 companies must meet this obligation.

The NFRD also applies to:

- Asset managers; exchange-traded funds, investment funds, pension funds;

- Insurance companies;

- Banks.

These entities must show which part of their portfolio or loans is in line with Taxonomy. In order to be able to report on this, relevant information is requested by financial institutions from companies or data suppliers.

It is expected by the EU that the Taxonomy will be applied more widely on a voluntary basis. Think of SMEs that provide products or services in line with the Taxonomy, such as specialist monitoring equipment for earthquakes or forest fires. It is optional for this group of companies to use the Taxonomy as a tool. The administrative burden can still be a barrier to do this voluntarily. In addition, there are several countries, banks and companies outside the EU with an objective to achieve a climate-neutral economy. The TEG has indicated that various countries, banks and asset managers from beyond the EU have expressed interest in full or partial implementation of the Taxonomy.

Challenges for companies

Little is known about the operation of the Taxonomy. The most extensive research to date is on companies whose shares are traded in the EURO STOXX 50 (Europe), CAC 40 (France) and DAX 30 (Germany). They fall within the group of companies that will be obliged to report in line with the Taxonomy. An analysis shows that less than 30 percent of the turnover within these indices qualifies for the Taxonomy (Adelphi, 2020). A maximum of 2 percent of the turnover of this group of companies appears to be fully in line with the Taxonomy. Of the companies 77 percent was in scope, but 1 percent or less was in line with the Taxonomy. The case of the automotive industry – which can make a substantial contribution through the production of electric cars – is noteworthy. 69 percent of the automotive industry is in scope, but ultimately less than 1 percent can prove that they meet the conditions for substantial contribution and no significant harm.

There are several reasons for big differences between high scope percentages and low alignment percentages:

- The Taxonomy does not yet cover all relevant economic activities;

- Technical criteria and definitions are unclear and multi-interpretable;

- Companies do not yet report relevant non-financial data showing whether they make a substantial contribution and/or cause significant damage;

- Internal processes and KPIs are not yet set up for the Taxonomy;

- R&D investments in new technologies are not included.

Despite the low percentages, 25 percent of the surveyed companies expect that the Taxonomy will ultimately delivers benefits (TEG, 2020; Adelphi, 2020). Nevertheless, there is an enormous task ahead.

Recommendations

The UN-supported Principles for Responsible Investment (PRI) has implemented the draft version of the Taxonomy in a test group with more than forty investors. Its report contains clear recommendations and lessons on this implementation (PRI, 2020):

- Reserve resources to integrate the Taxonomy;

- Develop a process to analyse companies on the Taxonomy. Start small, within a sector or region;

- Strictly adhere to the technical screening criteria and validate your data;

- Share experiences and demand support from data suppliers.

Although the Taxonomy is not definitive, it is recommended that all parties covered by the NFRD or linked in any other way to this obligation to report on the Taxonomy start to implement these recommendations.

What now?

The entire legal framework, to which the Taxonomy falls, the Taxonomy Regulation, comes into effect in phases. In addition, the criteria will be reviewed periodically in the coming years.

Until then, the European Commission is working on the development and implementation of the Taxonomy according to this timetable:

31-12-2020: Definitive definition of technical screening criteria for climate mitigation and adaptation

31-12-2021: First publication for companies and participants in financial markets on the Taxonomy-based activities based on climate mitigation and/or adaptation.

31-12-2021: Establish technical screening criteria for all other environmental objectives

31-12-2022: Publication for companies and participants in financial markets of activities tailored to the Taxonomy based on all environmental objectives